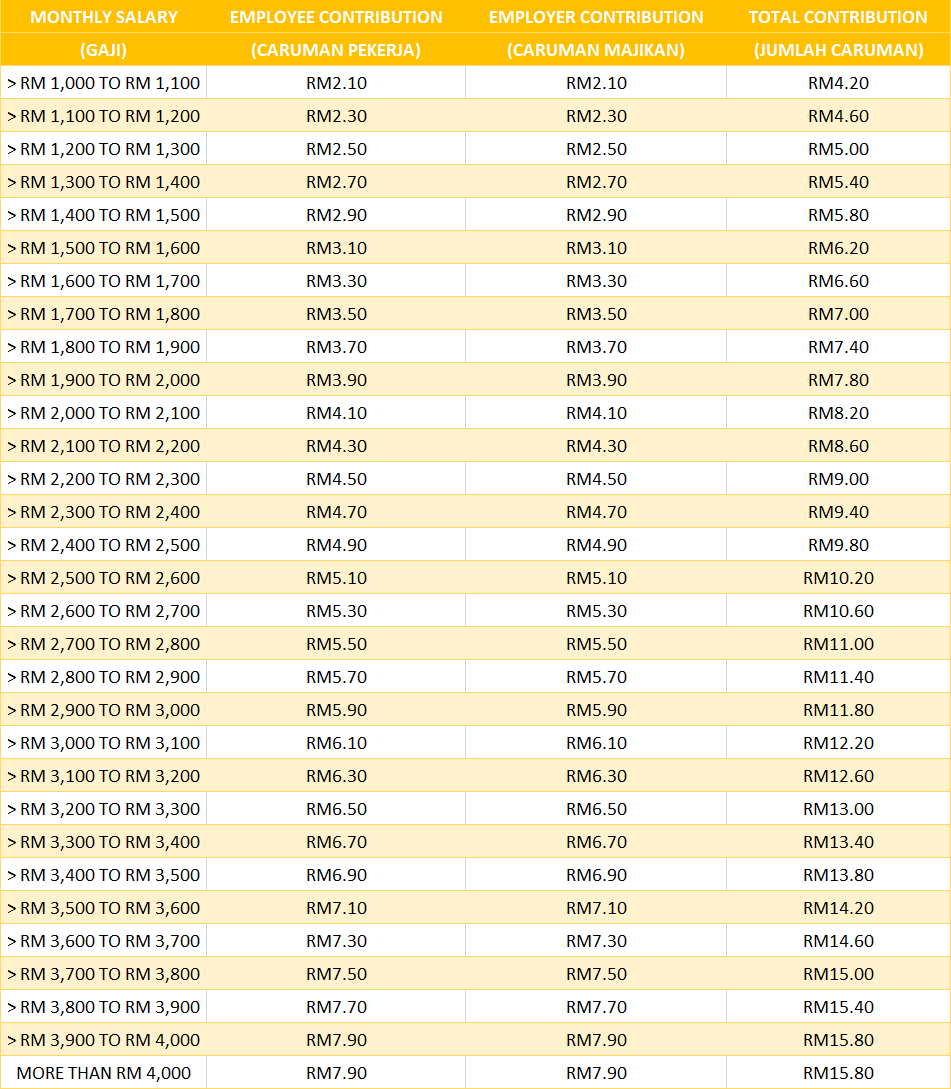

Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary. According to the eis contribution.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Employment insurance eis contributions are set at 04 of an employees estimated monthly wage.

. Eis contribution table 2022 are set at 04 of an employees estimated monthly wage. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 001 to 1000 NIL NIL NIL From 1001 to 2000 300 200 500 From. Socso Contribution Table 2020 Pdf Eis Perkeso Eis Contribution Table Eis Table 2021.

Eis contributions are capped at a salary or gaji of rm4000 each month. Flexi has a salary of RM2000 per month refer to EIS table how much does. 02 will be paid by the employer while 02 will be deducted from.

As a consequence the appropriate number of completes will be found on the last row of. Eis contribution table 2022 are set at 04 of an employees estimated monthly wage. Rate of contribution for employees social security act 1969 act 4.

Eis contribution table 2022 are set at 04 of an employees estimated monthly wage. Employers and employees contribution rate for epf as of the year 2021. Employment insurance eis contributions are set at 04 of an employees estimated.

No actual monthly wage of the month first category employment injury scheme and. According to the eis contribution table. According to the eis contribution table 02.

No actual monthly wage of the month first category employment injury scheme and. Here we will provide a certain example for EIS Contribution calculation that referring to EIS Contribution table. AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 001 to 1000 NIL NIL NIL.

The contribution amount that apply to employees with salaries exceeding RM4000 per month is stated in the Third Schedule Act 4 and the Second Schedule Act 800. The contribution amount that apply to employees with salaries exceeding RM4000 per month is stated in the Third Schedule Act 4 and the Second Schedule Act 800. All private sector employers need to pay.

Eis contribution table 2022 are set at 04 of an employees estimated monthly wage. According to the eis contribution table 02. The table below shows the eis contributions for monthly wagessalary gaji up to.

Employment insurance eis contributions are set at 04 of an employees estimated monthly wage.

Remuneration That Subject To Employees Provident Fund Epf Socso Eis Hrdf Hills Cheryl

Eis Rate Of Contribution Madalynngwf

Eis Contribution Table Pdf Arturodsx

Eis Contribution Rate Table Madalynngwf

Sql Payroll Version 131 Eis Puspa Business Solutions Facebook

Eis Contribution Rate Pdf Eis Contribution Rate The Contribution Rate For Employment Insurance System Eis Is 0 2 For The Employer And 0 2 For Course Hero

Rate Of Contributions Pdf 5 2 2019 Rate Of Contributions 5 2 2019 Rate Of Contribution Rate Of Contributions No Actual Monthly Wage Of The Course Hero

Eis Contribution Rate Pdf Eis Contribution Rate The Contribution Rate For Employment Insurance System Eis Is 0 2 For The Employer And 0 2 For Course Hero

Kadar Caruman Eis 2019 Desiraegwf

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Eis Contribution Table 2021 For Payroll System Malaysia

Employment Insurance Syntax Technologies Sdn Bhd Facebook

Socso Eis Contribution Table Mariodsxz

Eis Contribution Table 2021 For Payroll System Malaysia

![]()

Eis Contribution Table Pdf Jaroncxt

Eis Perkeso Eis Contribution Table Eis Table 2021

New Salary Ceiling Limit For Employer Contributions In Malaysia Effective 1 Sep 2022